How to place a bid on an auction

You can participate in auctions directly through the Marketplace. Follow the steps below to place a bid on a music catalogue in the Primary Market.

-

Go to the Marketplace tab.

-

Browse the active auctions listed in the top banner.

-

Click View catalogue on the catalogue you’re interested in.

-

Review the information on the Catalogue page to learn about past royalties, distribution frequency, and rights involved.

-

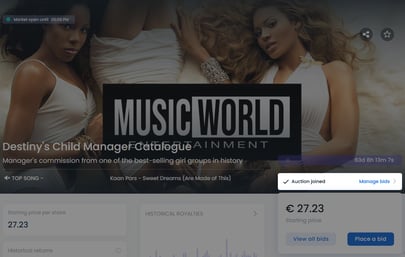

Click Place a bid.

- Set your bid using ‘Price view’ or ‘Budget view’

- In ‘Price view’: specify whether to match the highest or the lowest bid. Be mindful that bids may miss out on winning the auction if they get outbid by higher bids.

- In ‘Budget view’: specify the total amount of money you are willing to invest, while the platform will calculate how many shares that equals, using the lowest winning bid.

- Click on ‘Place a bid’

- Review and verify your bid

- Click ‘Confirm bid’ to finalise placing your bid.

Your bid is now active! You can monitor the auction's progress and allocation status from your Portfolio.

Managing your bids

-

You can view, update, or cancel your active bids in the Portfolio section or the auction page at any time before the auction ends. However, if your bid is winning, you won't be able to delete it within the last 36 hours of the auction or, the last 24 hours if the auction has reached 100% of its target. You can still place a new bid for a different price. To learn more about the 36 hours condition, please check: Cancelling a bid within the last 36 hours of auction

-

If you want to increase your bid, you can cancel the current one and submit a new bid with a new price.

If you have further questions about placing a bid, contact us at support@anotemusic.com.